Do You Know these Massachusetts Driving Laws?

Here in the US, the driving laws that you must follow depend on the state in which you’re driving. That means that Massachusetts has its own set of driving laws that are different from every other state, including even our neighboring states of New York, Connecticut, Rhode Island, New Hampshire, and Vermont.

Hopefully, you caught our featured article a few weeks ago about the new Massachusetts headlight law that went into effect on April 7, 2015. (If not, go ahead and catch up on that blog post now!)

If you were curious as to some of the other Massachusetts specific driving laws, today is your lucky day! We’ve scouted out just a few of the driving laws that are unique to Massachusetts. Read more about them below:

1. Accident Reporting – In Massachusetts, you are required to report accidents in cases of injury and death, and also if property damage exceeds $1,000. The accident must be reported within five days.

2. Child Passenger Safety – Children under age 8 and under 4 feet 9 inches tall must have a child safety seat. Children aged 8 through 12 need a properly adjusted safety belt or child restraint. In addition, all drivers and passengers in Massachusetts must wear seatbelts, with few exceptions.

3. Cell Phones and Texting – Cell phone use is prohibited for school bus drivers and all drivers under the age of 18. Texting is banned to all drivers in Massachusetts.

4. Speed Limits – Unless otherwise posted, Massachusetts has suggested speed limits of 65 mph for rural and urban interstates. Speed limit citations have a minimum penalty of $75. This fine increases $10 for each mph you were travelling over the first 10 mph.

5. Mature Drivers – For drivers 75 and older, license must be done in person and every five years.

6. Work Zones – If you are caught speeding in a work zone in Massachusetts, you can get an enhanced penalty of double the original fine. Workers don’t need to be present for this to happen, though the zone must be marked with signs.

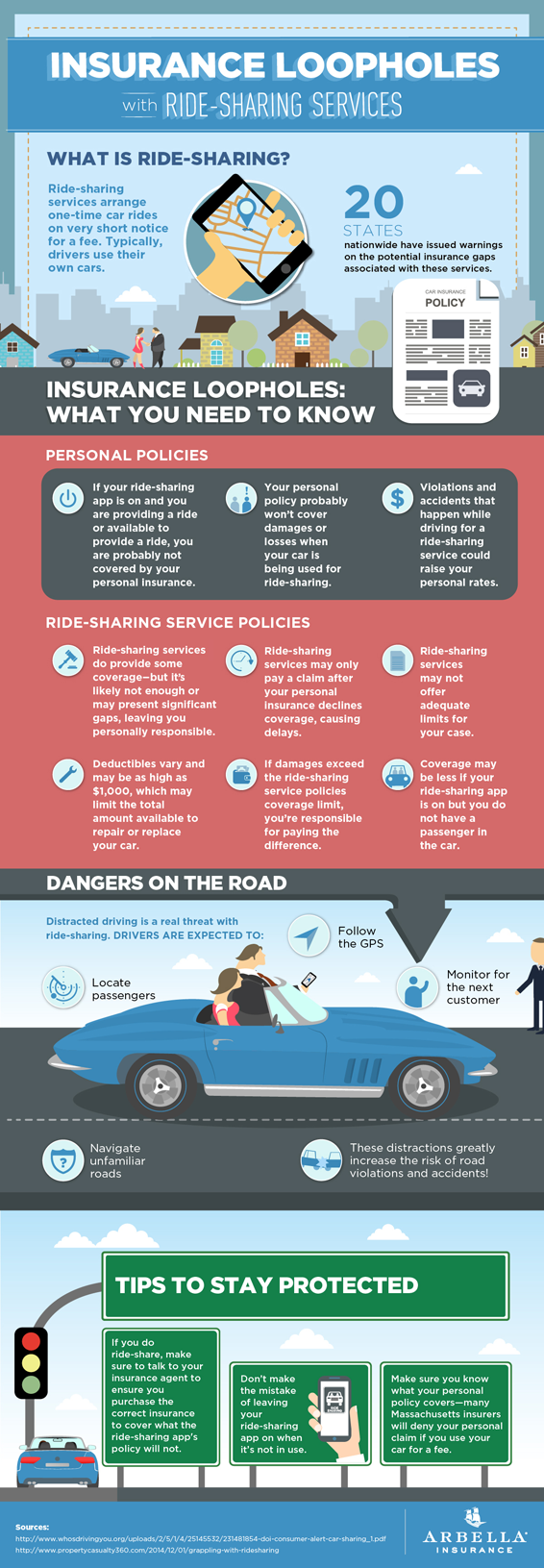

In addition to all of these laws, there are minimum Massachusetts Auto Insurance requirements. Every car in Massachusetts must have the following coverage:

- Bodily Injury to Others – $20,000 Per Person and $40,000 Per Accident

- Personal Injury Protection (PIP) – Pays up to $8,000 for Medical Expenses

- Bodily Injury and Uninsured Motorist – $20,000 Per Person and $40,000 Per Accident

- Property Damage to Another Person’s Property – $5,000

It is important to remember, though, that these are the minimum requirements. To ensure proper protection, call a Vargas and Vargas Insurance agent at 617-298-0655. There, you can get a quote for auto insurance protection that will provide protection for your property, yourself, and your loved ones.

Please make sure that your friends and loved ones know these Massachusetts driving laws by sharing this post on Facebook or Twitter with the buttons below. Also make sure to tell them about how Vargas and Vargas Insurance Agency can get them a fast and free insurance review.