Prepare Before Hurricane Season: Tips from Vargas & Vargas Insurance

Hurricane season, runs from June 1st to November 30th, can be pretty daunting with all the strong winds and heavy rains. Each year, there are about ten to sixteen named storms, including four to eight hurricanes, and some with winds over 155 mph! Preparing your house and family for these storms is super important, so here’s a guide to help you get ready and stay safe.

Stock Up Early and Keep Supplies Handy

Before the hurricane season kicks off, it’s a great idea to gather all the essentials. Stock up on non-perishable food, water, medications, and other supplies like flashlights and batteries. Keeping these items in an easily accessible emergency kit means you won’t be scrambling to find them when you really need them.

Prepare Your Home

Make sure your home is as strong as it can be before the storms hit. Start by trimming trees and shrubbery; loose branches can fly like missiles during a hurricane. Secure your windows and doors, and if you have storm shutters, make sure they’re properly installed. You might also want to reinforce your garage door and secure loose items around your property to minimize damage.

Unplug and Protect

Electrical surges are common during hurricanes, consider plugging your devices into surge protector outlets like this one or unplug your electronics to protect them from damage. This simple step can save you a lot of trouble later.

Plan for Power Outages

Hurricanes can knock out power for a long time. Having a backup generator can be a lifesaver, ensuring you have electricity even when the grid is down. Installing a battery backup for your sump pump is also smart to prevent flooding in your home. Fill up your bathtubs with water in case you lose access later

Know Your Evacuation Plan

Understanding where to go and how to get there can save precious time during an evacuation. Plan your routes to a safe location, perhaps a friend’s house outside of flood-prone areas. Remember to have a strategy for your pets and check local options for emergency transportation if you don’t have a vehicle.

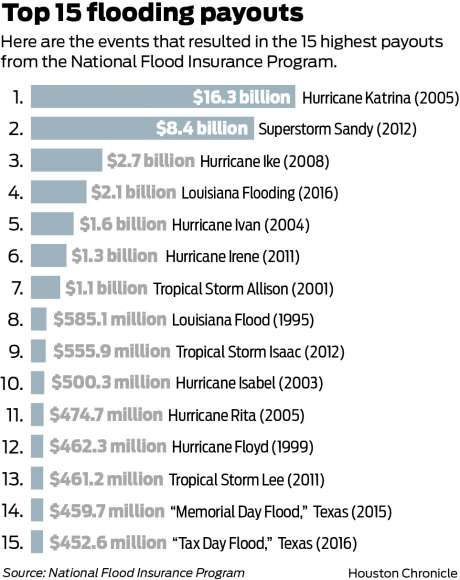

Review and Update Your Insurance

Before the storm season gets too intense, take a moment to check your insurance coverage. It’s crucial to have the right amount to rebuild your home if the worst happens. You might want to check if you need specific flood coverage, as it’s not included in standard home and renters policies. Vargas & Vargas Insurance, one of the premier local independent insurance agencies, can help you customize your coverage to fit your needs. For an insurance check-up or more information about the National Flood Insurance Program, call us at 617-298-0655.

Digital Safeguards

Creating digital backups of important documents like insurance policies, identification, and property records can be lifesaving if physical copies are lost during a storm.

How We Can Help

Vargas & Vargas Insurance works for our clients, not the insurance company. We’re here to tailor your insurance coverage to your specific needs and help answer any questions you might have. Contact us today to ensure you’re fully protected this hurricane season.

By taking these steps, you can ensure that when the wind starts howling, your home and family will be safe and secure. Don’t wait until it’s too late—start preparing now to stay safe and protected during hurricane season. Call Vargas & Vargas Insurance at 617-298-0655 for all your coverage needs. Stay prepared and peace of mind will follow!