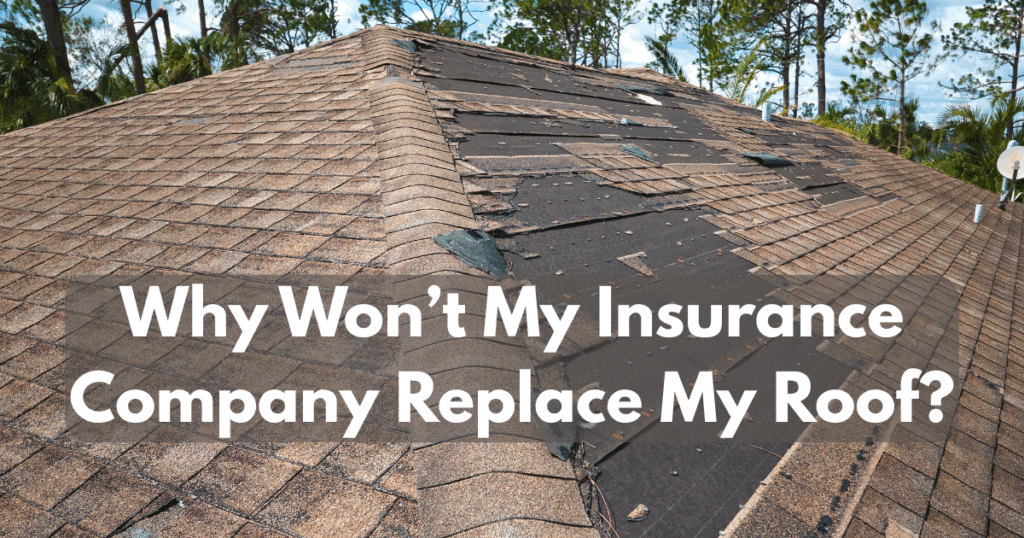

Why Won’t My Insurance Company Replace My Roof?

If you’ve recently filed a claim for a roof replacement and your insurance company denied it, you’re not alone. Many homeowners assume their insurance will cover a new roof after damage, only to find out that’s not always the case.

So, why won’t your insurance company replace your roof? The answer often comes down to policy terms, the cause of damage, and the age of your roof. Let’s break it down.

1. Insurance Covers Sudden Damage, Not Wear and Tear

One of the most common misconceptions about home insurance is that it covers all roof damage. The reality? No property insurance policy is a maintenance policy.

That means gradual wear and tear, neglect, or aging won’t be covered. Insurance is designed to protect against sudden, unexpected events—like:

✅ Hailstorms

✅ Fallen trees

✅ Fire

✅ Windstorms (depending on your policy)

However, if your roof is simply old or deteriorating from age, poor maintenance, or previous unreported damage,your claim may be denied.

🔍 Example:

If a hailstorm damages your 5-year-old roof, your insurance will likely cover repairs or replacement.

But if a 20-year-old roof starts leaking due to worn-out shingles, that’s considered normal aging—which insurance won’t cover.

2. The Age of Your Roof Matters

Many insurers have roof age limits when it comes to full replacements. If your roof is 15 to 20 years old, your coverage may be limited to actual cash value (ACV) rather than the full replacement cost.

- Replacement Cost Value (RCV): Pays for a new roof at today’s prices, minus your deductible.

- Actual Cash Value (ACV): Pays only for the depreciated value of your roof, meaning you’ll receive significantly less money.

If your insurer only offers ACV coverage, you may need to pay a large portion of the replacement cost out of pocket.

🔗 Check out this guide from the Insurance Information Institute to understand how roof insurance coverage works.

3. Pre-Existing Damage or Poor Maintenance Can Lead to Denials

If an insurance adjuster inspects your roof and finds signs of pre-existing damage—such as missing shingles, previous leaks, or mold growth—they may reject your claim.

This is why regular roof inspections and maintenance are crucial. Many policies state that homeowners must take reasonable steps to maintain their property—and failing to do so can result in denied claims.

What Can Cause a Denied Roof Claim?

🚫 Improper installation

🚫 Neglect or lack of maintenance

🚫 Existing leaks before a storm

🚫 Roof damage not reported in a timely manner

If an insurer suspects your roof was already compromised before the claimed event, they may deny coverage.

4. Certain Weather Events May Not Be Covered

Did you know that some policies exclude specific types of storm damage?

For example, if you live in a hurricane-prone area, your insurance might have a hurricane or windstorm deductiblethat requires you to pay a portion of repairs out of pocket before coverage kicks in.

Similarly, earthquakes and floods are not covered under standard home insurance policies—you’d need separate policies for those.

Pro Tip: Always review your policy exclusions and discuss coverage details with your insurance provider.

🔗 Learn more about what home insurance covers from the National Association of Insurance Commissioners (NAIC).

5. Work With a Reputable Roofing Contractor for an Inspection

If your claim is denied, it’s important to get a second opinion from a trusted roofing contractor. Sometimes, insurance adjusters miss critical damage or incorrectly classify the issue as wear and tear.

Working with a professional roofer can help you:

✔️ Identify legitimate storm damage

✔️ Document necessary repairs for an insurance appeal

✔️ Ensure your roof is properly maintained to prevent future claim denials

🔗 Mario’s Roofing is a trusted local roofer that provides high-quality roof inspections, repairs, and replacements. If you suspect your roof has damage, reach out for a professional evaluation.

What You Can Do If Your Roof Claim Is Denied

If your claim is denied, don’t panic. Here are some steps to take:

✅ Request a detailed explanation of the denial from your insurance company.

✅ Check your policy to ensure the claim should or shouldn’t be covered.

✅ Get a second opinion from an independent roofing contractor.

✅ Consider appealing the decision with additional evidence, such as photos and maintenance records.

✅ Ask about partial repairs if a full replacement isn’t covered.

Final Thoughts: Be Proactive About Roof Maintenance

Your home insurance is there for sudden damage—not maintenance issues. The best way to ensure coverage is to stay ahead of roof problems by:

✔️ Getting annual roof inspections

✔️ Fixing small issues before they become major problems

✔️ Keeping documentation of repairs and inspections

If your roof is nearing the end of its life, contact a trusted roofing contractor to assess whether it’s time for an upgrade—before damage leads to costly repairs or denied insurance claims.

Not sure how your current policy would respond if something happened? Reach out to the experts at Mario’s Roofing for guidance. They’ll help you understand your options and work alongside your insurer to keep your home fully protected.