Month: November 2019

Three unique factors regarding classic auto insurance

Standard auto insurance isn’t typically enough for those who own a classic automobile. Such an automobile tends to be more valuable while also holding a lot of emotional value for the vehicle owner.

There are numerous factors that make classic auto insurance unique from standard auto insurance. The following are three unique factors:

Classic auto insurance usually reimburses for the full or “guaranteed” value of the vehicle in the event of a total loss.

A standard auto insurance policy won’t necessarily cover a vehicle for its total value in the event that it is completely destroyed in an accident. On the other hand, a typical classic auto insurance policy will usually cover the vehicle for its full, guaranteed value. This value is usually mutually agreed upon by the vehicle owner and the insurance company at the time that the policy is purchased

A classic car insurance policy typically covers a vehicle that is between 19 and 24 years old.

With most insurance providers, a vehicle that falls in between 19 and 24 years old should be covered under a classic auto insurance policy. On the other hand, an older vehicle would be covered under a policy specifically designated as an “antique” auto insurance policy.

Another common type of auto insurance policy for collectors is the modified car insurance policy. This is used for vehicles that have been heavily altered by the owner in terms of their engine, chassis, interior, or another factor.

Additional features included in classic auto insurance include Auto Show Medical Reimbursement and No Attendance Required features.

There are numerous unique options available for classic auto insurance. Two examples are auto show medical reimbursement and no attendance required features.

Auto show medical reimbursement provides coverage for damages when an accident is caused by a vehicle in the events of an auto show. No attendance required means that the policy will cover damages even when the vehicle owned isn’t present when the accident occurs.

If you are looking for a classic auto insurance policy for your vehicle, contact us at Vargas & Vargas Insurance to learn more about the policies we offer for vehicle owners in Dorchester, MA.

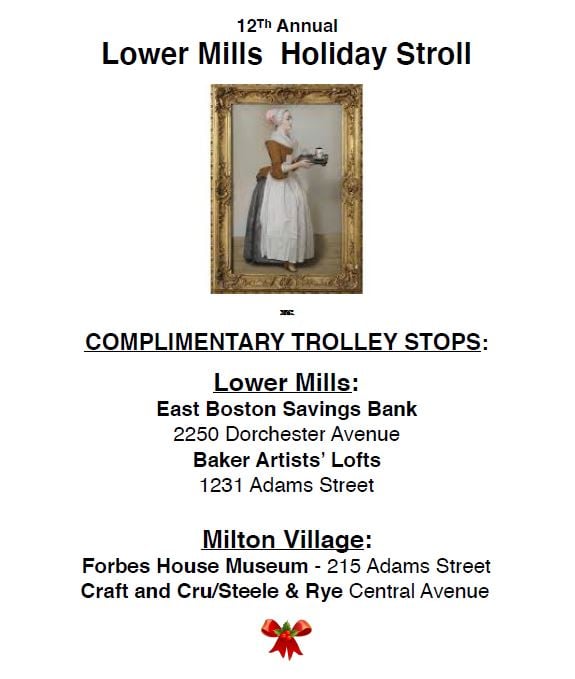

Holiday Travel Turmoil

This week marks the busiest travel holiday of the year. Historically, the statistics prove that millions are driving and flying this week to celebrate with loved ones for this upcoming Thanksgiving holiday.

With this busy travel season comes delays and frustration. If it’s not the weather, then it’s crowded airlines, bus terminals and congested highways. If that doesn’t promote stress, I’m not sure what does. In fact,

Depending on where you are located and to where you are traveling, you could be facing inclement weather such as snow, freezing rain, and sleet creating slippery roads. And even if the dangerous, delaying weather isn’t where you’re located, it could be brewing at your destination location. Or, if you’re flying, then bad weather elsewhere in the country can affect your flight departures/arrivals, even in sunny climes.

Many are used to traveling and many are used to purchasing insurance. When was the last time you considered purchasing travel insurance. Yes, it’s a thing and it has saved clients hundreds and thousands of dollars from canceled and upended travel plans.

Depending on the type of policy, travel Insurance may cover accident and sickness medical expenses, emergency medical evacuation/repatriation, trip delays, cancellation, interruption, missed connections due to severe weather and a host of other reasons beyond the traveler’s control.

During this busy travel season, reduce your stress. Take control of something within your control: minimizing lost costs of what would have otherwise been a joyful trip.

It should be noted that one of the drawbacks is you must plan your travel insurance protection ahead. Many travel insurance carriers, depending on the type of coverage they offer, must booked at the time the trip is booked.

Call us today to review how your travel plans can be saved.

Does Your Renters Insurance Cover Stolen Packages?

Most renters insurance policies cover replacement items everywhere, not just at your home. This includes items stolen off your porch or in front of your door. It also covers your laptop if your friend douses it in a latte at the coffee bar. It will even cover luggage that you may have lost on vacation.

However, one thing to consider is the deductible. Some deductibles are either $500.00 or $1,000.00. Since a renter has to pay the deductible, is it even worth filing a claim? If it was a $1,200.00 laptop or television, then it’s worth your time and the cost of the deductible. But if it was a $30.00 child’s toy, it may not be worth your time.

What Steps Should You Take If Something Is Stolen from Your Porch?

Research shows that over 25 million people have packages stolen every year. The majority of carriers have a package tracking system, so you can determine if it was stolen or just delayed. Along with renters insurance, you can use company claims policies to protect both your large and small deliveries. Each carrier has different rules:

United States Postal Service

USPS makes you wait seven days to file a claim. They need to know the sender and recipient addresses, tracking number, package dimensions, and a description of the package’s contents.

Always remember to insure the package. Without this step, the only thing you get back is the cost of the shipping.

FedEx

FedEx lets you or the seller file a claim. They typically cover up to the lesser of $100.00 of the total shipment value or the total amount that you insured it for. FedEx processes claims quickly, so you should receive a payment within a week of filing.

United Parcel Service (UPS)

UPS also has a claim process for lost packages. UPS has online procedures for both lost and damaged packages. You can begin the filing process if you don’t have your package within 24 hours of the anticipated delivery time.

Amazon

Amazon’s A to Z Guarantee for Buyers covers up to $2,500.00 of the purchase price. First, you must contact the seller for a refund. If they are unwilling to work with you, then you can file a claim. However, you must file the claim between 15 and 90 days from the purchase date. If the claim is accepted, you can get a full refund up to the 2,500.00 limit.

If you frequently have packages delivered to your apartment or rented home, or you’re worried about your belongings, renters insurance can help. Contact our team at Vargas & Vargas Insurance to learn more about the benefits of a renters insurance policy from a local service provider.

Flashback Blog: Boston is No Stranger to Fire

The city of Boston has been destroyed by large blazes multiple times. The first devastation of fire occurred in 1631; just one year after Boston was officially established.

Here are a few tips to keep you from having to file a fire damage claim on your home insurance.

The first thing you should cement in your mind is to never leave a flame burning where it cannot be seen. Enjoying an aromatherapy session with some scented candles? Even if you need to leave the room for just a moment, blow them out. You never know if something will delay or distract you from returning immediately.

Keep pets, especially agile cats, away from lit candles, scented oil burners, and other open flames. They could bump or knock over the materials, causing a fire that could have been avoided. On the same train of thought, teach your children proper fire safety. Flames and the resulting smoke can be very dangerous.

In case a fire does occur, despite your best efforts to handle flames safely, make sure you have up to date insurance in Boston, MA. Boston boasts median home values above $100,000.

Without coverage, how would you repair or rebuild your home after a fire ravaged your property? Avoid this potential financial burden by requesting a free insurance estimate today and putting your coverage in place.

With Vargas & Vargas Insurance, you can get the coverage you need for your home. Click here to contact us today for more information!

How to Prevent Home Damage from Frozen Pipes This Winter

Fall may be in full swing, but for Northeasterners, winter weather is already here. This puts homeowners on high alert as lengthy periods of sub-freezing temperatures means an increased risk of pipes freezing and bursting. Damaged pipes are not merely an inconvenience. They can cause serious damage to a home’s integrity. Fortunately, preparing your house for icy weather can prevent these unfortunate scenarios from occurring. Reducing the risk of frozen pipes is just one of the ways to keep your home ready for winter.

Why Are Frozen Pipes Dangerous?

Water expands when it freezes. This puts excess pressure on pipes and can cause them to crack or burst. Preventing pipes from freezing in the first place will keep your pipes intact and protect your home from damage.

How Can You Prevent Pipes From Freezing?

Prevention is the first step. Take these steps to reduce the risk of frozen pipes inside your house and frozen exterior pipes:

- Turn off all outside water sources.

- Keep your house warm. Program your thermostat and leave it at the same temperature day and night, even when you leave.

- Open the cabinets in the bathroom and kitchen to allow warm air to circulate around the piping.

- Keep your garage doors closed. Cold drafts and wind increase the likelihood of pipes freezing.

- When the weather gets exceptionally cold, let water drip from the faucet. This can relieve pressure in the pipes and keep the water moving.

- If you won’t be home for a long period of time, turn off the water supply line to your washing machine.

- Cover pipes with insulation or other products meant to insulate them.

- Have a friend walk through your home regularly if you will be away for an extended period of time.

- Clearly label the water supply line so you can easily identify it later. This can help you turn it off quickly if an emergency ensues and it needs to be turned off.

What Should You Do If Your Pipes Freeze?

If your pipes freeze, there are several steps you can take to minimize the resulting damage. These steps include:

- Keep the faucet open. As the ice starts to melt, the flowing water will help the rest of the ice melt.

- With a space heater, heating pad, or heated towels, apply warmth to the frozen length of the pipe.

- Never use an open flame, such as a blow torch or propane stove, in an attempt to warm the pipes.

If you do experience damage to your home due to a frozen or burst pipe, rest assured that our team at Vargas & Vargas Insurance will be on hand to assist you. Contact us today to learn more about our policies or for help protecting your home.

DIY Has Its Limits

Our society has become enthralled with the concept of “do it yourself” or “DIY.” So much so that entire industries have grown up around the idea that anyone, anywhere, with access to tools, materials and knowledge, can do just about anything they set their mind to.

This DIY mentality extends to our home. Repairs, renovations and other home improvement projects abound in this mindset.

The traditional craft of repair and renovation has been upended with this modern consumer concept. Imagine you’re an electrician and you’ve entered a Big Box Home Hardware store. As you walk down the aisle filled from floor to ceiling with electrical supplies of all types, you see a person standing in front of a display of electrical outlets. This person clearly is not an electrician, and clearly is struggling with the selection of the appropriate outlet which you’re pretty sure they’re going to attempt to install themselves.

Imagine the horror in your mind as that electrician thinking of the potential visit to the Emergency Room for that person when the wrong wire gets crossed.

And, yet, these traditional industries still thrive. The reason? No amount of online videos, tutorials or DIY books can replace the wisdom that comes from specializing in a task and learning the “tricks of the trade from experienced professionals.

If you have trees on your property, it’s your responsibility to think about the maintenance of those trees to protect your home in the event of a severe storm that could topple in close proximity to your house.

If you’re thinking about trimming, or even taking down trees for that maintenance and protection. Should you do it yourself?

The best way to answer the question is to watch a professional tree-trimming crew in action. You’re likely to very quickly realize that such work…taking down or trimming a tree…is best left in the hands of the experienced professionals.

Those “tricks of the trade” that come from the traditions and wisdom handed down in the craft become very quickly obvious as you watch the crew scale up a tree and easily slice away branches and limbs. And then when they have to take down an entire tree, the process seems at once intricate and yet elegantly simple.

Yes, sometimes it’s really best to not do it yourself and to leave it to the professional.

One of the most FAQs we receive is when a tree falls on your property but doesn’t hit your house or any physical structure, there is no insurance coverage to pay for the removal of the tree.

Call us for any recommendations you may need to help with your home improvement projects.

Please read our other blogs related to home maintenance projects.

You can reach us by calling 617-298-0655 or text us at 617-409-0329 for a free, no-obligation annual review. Click here to Visit our Contact Us page.

Archive Revival: Why Is Renter’s Insurance Important?

Most people fall into one of two categories: They either own their home or they rent it.

If you rent your home, you don’t need a homeowner’s insurance policy.

You need what’s called renters insurance. This type of insurance policy will ensure that you have the right coverage when you need it the most.

We’ve outlined below how homeowner’s insurance and renter’s insurance are similar and and how they differ. Here is our quick summary:

Property Protection

When you rent your home, you don’t own the physical property. As a result, you are not responsible for insuring the property. Instead, the insurance policy is the responsibility of the property owner.

This means that if there is damage to any part of the exterior and interior of the property including walls, ceilings, floors, doors, or windows, you are not responsible for filing or paying for an insurance claim.

Coverage for Belongings

Similar to a homeowner’s insurance policy, a renter’s insurance policy provides coverage for your personal belongings. You need to take inventory of your belongings to give an estimate on what it would cost to replace your belongings.

When you make your home inventory, make sure that you include everything that you own, including items like electronics, furniture, clothing, and jewelry. Also include any of your own personal appliances that are not owned by your landlord or apartment complex. That way, all of your stuff will be protected against perils like fire, smoke, theft, water damage, and more.

We recommend keeping the receipts of high valued items. We also recommend storing photos of each of your rooms so you have documentation of your belongings. This will help to ensure that you are covered in case of a total loss, but aren’t overpaying for coverage that you don’t need.

Reimbursed Living Expenses

If something happens to the place where you live, your renter’s insurance typically covers your living expenses for a comparable place until the damage is repaired and your home is once more inhabitable.

If your rental home or apartment is destroyed or deemed uninhabitable, call your insurance agent right away to find out what you should do so that reimbursement is allowed.

Liability Insurance

Another type of coverage that is typically included in both renters and home insurance is liability insurance. With this coverage, you are financially protected from the costs that rise if someone is injured at your home.

Depending on your insurance provider and the policy that you choose, this can include both medical costs and legal costs, which can get very expensive, depending on the injury sustained.

As always, all of the information above depends on your insurance provider and your specific policy.

We search several insurance providers to find the one that will give you the best coverage at a price that works for you and your budget.

Cost?

On average, the cost of a renters insurance policy is $120.00 per year for $10,000 of contents, including loss of use and liability coverage, Click here for more details) in Massachusetts.

If you package your automobile insurance policy with your renter’s insurance, most times, the savings by doing so more than covers the cost of the renter’s policy.

If you have any questions about the coverage included in your current policy, or if you need a new top of the line renters insurance policy quote, please call 617-298-0655 to speak with a representative here at Vargas and Vargas Insurance Agency.