When was the last time that you needed a ride at the last minute? If you didn’t want to inconvenience a family member or friend, you may have called a taxi or scheduled a ride through a limousine company. There is a new option entering the market for people in this predicament, though. It is called “Ride Sharing,” and though the concept may sound technologically savvy, it presents several concerns to drivers and passengers that use the associated apps.

The Rise of Ride Sharing Apps

In the old days, you used to have to hire a limo or a cab if you needed a ride on short notice. Nowadays, though, there are several apps that provide Ride Sharing services. It’s a way for drivers to earn some extra cash providing rides whenever they can, using their personal vehicle.

Using one of these apps as easy as installing Uber, Lyft, or Sidecar and requesting a ride. A verified driver will pick you up and take you to your destination. You can even pay the driver, rate them, and tip them through the app in most cases.

The Auto Insurance Conundrum

For the most part, a ride that is taken (or given) with a ridesharing app can be broken down into three parts. The first is when the driver is looking for work, but does not yet have a client. The second is when the driver is on their way to a waiting client. And the third (as you could probably guess) is when the driver is transporting the client.

The issue that is cropping up all over the country is this: What happens when a driver is in an accident? Ride Sharing companies claim to provide excess liability insurance for their drivers, but consider this scenario: in California, an Uber driver hit and killed a six year old girl on his way to pick up a customer. The driver’s personal auto insurance policy says that Uber should be responsible because the app was active, but Uber is refusing liability because there was no passenger in the car at the time of the accident. And that’s just one example of a case – there are many more cases like this happening throughout the country, and drivers are learning the hard way that the insurance situation in these cases is very complicated.

Insurance Loopholes

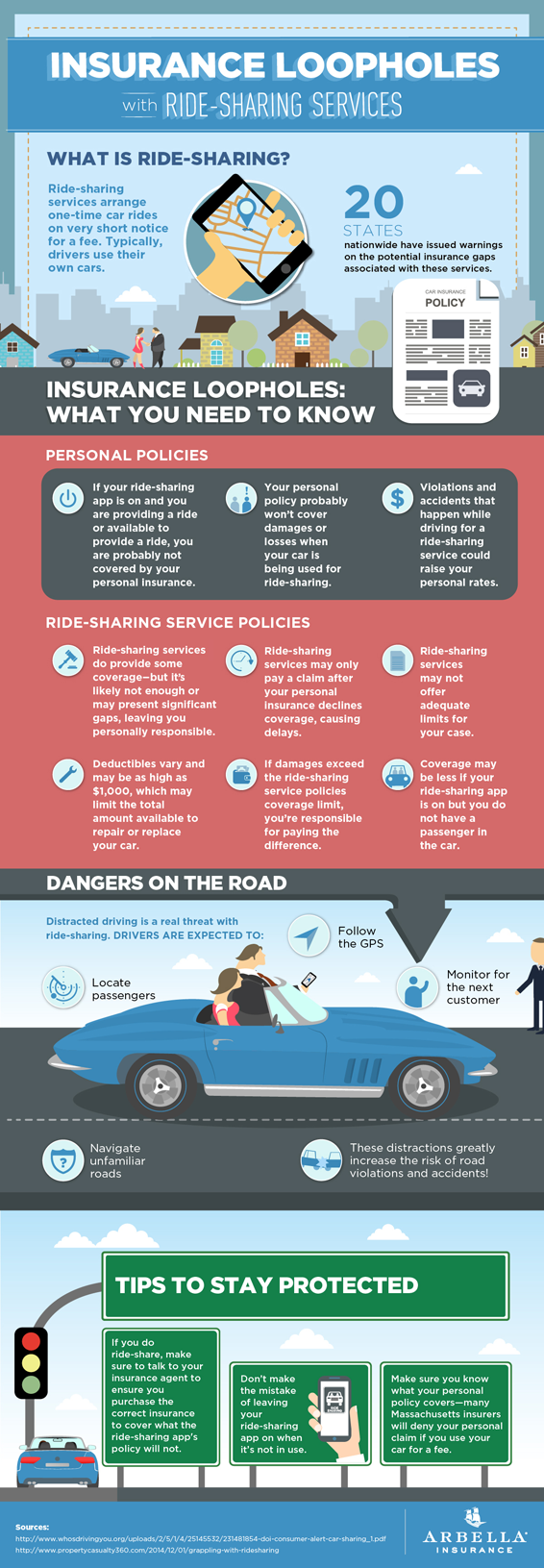

An infographic provided by our friends at Arbella Insurance shows just a few of the insurance loopholes that you may encounter if you drive for a ridesharing company:

If you are running a ride sharing application, your personal auto insurance policy may not cover you for damages or losses.

Violations and accidents that occur when you are running a ride sharing app could still cause an increase in your personal insurance rates.

Ride Sharing services may provide you with additional liability insurance, but their coverage may have significant gaps. Deductibles on their insurance may also be as high as $1,000. And if they don’t provide enough coverage, you could be responsible for the difference!

So before you start to hire out your car to make a little bit of extra cash, you should carefully consider the risks that you could be undertaking. If you are still interested in taking part in the Ride Sharing phenomenon, make sure that you call your Vargas and Vargas Insurance agent at 617-298-0655 before you even think about picking up your first customer. As auto insurance experts, we will be able to help you ensure that you’re covered in all of the situations that you encounter on the road – even if you have a client in tow.

*Edit: There is now coverage available for drivers while they are logged in to ride sharing apps but do not have an active passenger. Read more on Insurance Journal here: ISO Introduces Endorsements to Address Ridesharing Policy Gaps