So, you have taken the first step: you have a home insurance policy! This guarantees that you will be covered in case of a covered peril. But wait – if your personal property is destroyed, do you have a record of what you own, and how much it is worth?

So, you have taken the first step: you have a home insurance policy! This guarantees that you will be covered in case of a covered peril. But wait – if your personal property is destroyed, do you have a record of what you own, and how much it is worth?

It is for exactly this reason that you need some sort of home inventory system. This document will help you keep up to date with all the valuables in your household, and will be critically important if you ever need to make a home insurance claim on your personal property.

The process of creating a home inventory is actually simpler than it may seem. All you need is a computer, a camera, and a free weekend! Get started by following these steps:

1. Choose your method of documentation.

There are many different ways that you can record your home’s inventory. You could always go ‘old school’ with pen and paper, but nowadays we would suggest more modern methods. For example, you could use a spreadsheet program such as Excel or online documents such as Google Documents. There is even software made specifically for creating a home inventory, such as Know Your Stuff®, presented by the Insurance Information Institute.

2. Visually document your entire household.

Once you know how you are going to keep track of your belongings, it’s time to get a feel for everything you have. With a camera in hand, take photos or video of everything in your home. Don’t skip anything – every nook and cranny is important. Make sure that you don’t forget your garage and your backyard!

3. Make your list’s first draft.

Now that you have your visuals, it’s time to craft your list. Go back through what you just captured, documenting everything worth over a certain dollar value (typically $50 or $100). Your list will be long, but that’s ok! You have a lot of stuff in your home that is worth protecting!

4. Fill in all of your details.

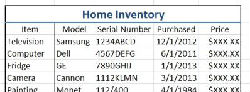

After you have a list created, you need to fill in the details. For every item on your list, record information about the item, such as:

- Brand Name or Manufacturer

- Model Number

- Serial Number

- Approximate Date Purchased

- Purchase Price

- Notes About the Item

This can get a little tedious, but in the long run, you’ll be glad that your information is thorough.

5. Keep it in a safe place.

When your home inventory is finally done, make sure that you keep it in a secure location. The purpose of this document is to serve as a record if your home is damaged, so keeping it in your home is ill-advised. Save a copy on the internet, and have one printed out to put in your safe deposit box or with a friend or family member.

6. Make sure it stays up to date.

Congratulations! You’re finally finished. But you can’t fully relax just yet – your belongings will probably evolve over time. You will get rid of some things and add others. If you don’t want to update your inventory with every big purchase, make an appointment every six to twelve months to ensure that your inventory stays current.

If you follow all of these steps, you will no doubt thank yourself if you ever need to file a home insurance claim on your personal property. This list has the potential to make a what can be a very stressful situation much less traumatic.

Also remember, if you have any questions about your Massachusetts home insurance policy, Vargas and Vargas Insurance is ready to assist you! We are always around to address concerns, and we are always glad to help!

All you have to do is call – our phone number is 877-550-0025.