The Benefits of Term Life Insurance | Blog | Vargas & Vargas Insurance

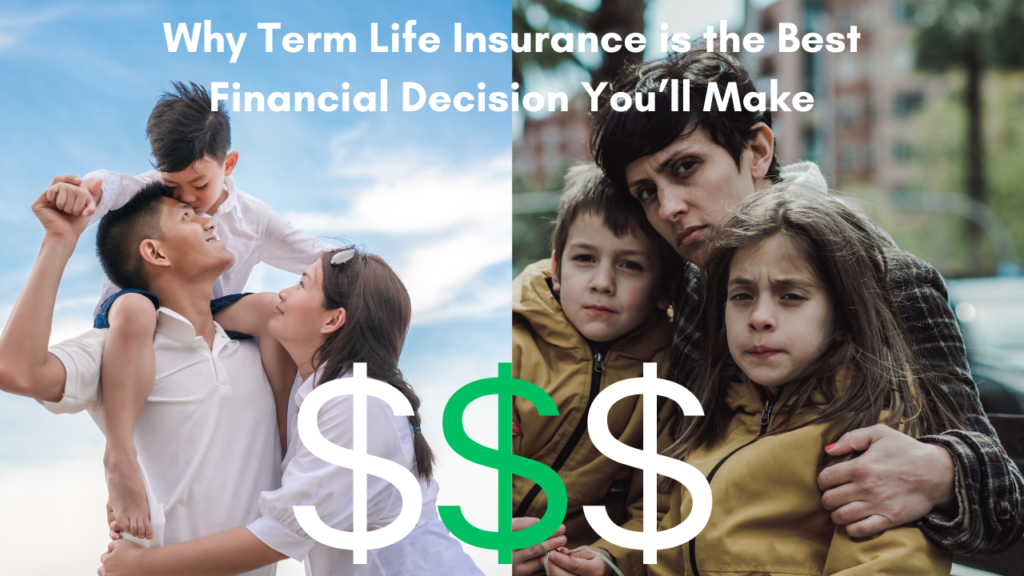

Term life insurance is a smart way to protect your family’s future. Let’s explore what it is and why it’s important.

What is Term Life Insurance?

Term life insurance is a type of protection that lasts for a specific amount of time. You choose how long you want it – maybe 10, 20, or 30 years. If something happens to you during this time, the insurance pays money to your family.

Why is it Useful?

- It’s Affordable

Term life insurance usually costs less than other types of life insurance. This means you can get a lot of protection without spending too much money. - It’s Simple

You pick how long you want it and how much protection you need. There aren’t many complicated rules or extras to worry about. - It’s Flexible

As your life changes, you can often change your insurance too. You might be able to make it last longer or turn it into a different type of insurance later.

Who Needs Term Life Insurance?

Many people can benefit from term life insurance, like:

- Married Couples

- Parents with children

- People who own a house and have a mortgage

- Anyone who helps support their family financially

It’s a way to make sure your family will be okay financially if you’re not around.

How to Choose the Right Policy

Picking the right term life insurance involves thinking about:

- How long you want the insurance to last

- How much money your family would need if something happened to you

- What you can afford to pay each month or year

It’s a good idea to talk to an insurance expert who can help you figure out what’s best for your situation.

Common Misunderstandings

Some people think:

- “It’s too expensive!” – Actually, term life insurance is often quite affordable.

- “I’m too young for it!” – Getting insurance when you’re younger can be smart because you are healthy and it costs less.

Why It’s Important

Term life insurance helps ensure your family has money for important things if you’re not around, like:

- Paying for housing

- Buying food and clothes

- Covering education costs

It’s a way to provide financial security for your loved ones, no matter what happens.

How to Get Started

Getting term life insurance isn’t too complicated:

- Think about your family’s financial needs

- Talk to an insurance expert (at Vargas & Vargas Insurance)

- Fill out an application

- Answer some health questions

- Wait for the insurance company’s to issue your insurance policy

Once approved, you’ll have protection for your family.

How Much Does Life Insurance Cost?

The cost of life insurance varies widely based on several factors, including:

- Age

- Health profile

- Lifestyle choices

For example:

- For a 20-year term policy with good health:

- 30-year-olds:

- Men: $1 million coverage – $43/month, $500,000 – $25/month

- Women: $1 million – $33/month, $500,000 – $20/month

- 45-year-olds:

- Men: $1 million – $106/month, $500,000 – $57/month

- Women: $1 million – $80/month, $500,000 – $45/month

- These are just examples. Your price might differ based on health and lifestyle.

It’s crucial to review your life insurance policy regularly to ensure it continues to meet your family’s changing needs and financial obligations.

Key takeaway: Life insurance costs are personalized and can change over time, so periodic reassessment is important.

Conclusion

Term life insurance is a practical way to protect your family’s financial future. It’s affordable, easy to understand, and gives you peace of mind. It ensures that your family will have financial support, even if you’re not there to provide it yourself.

Need Help? We’ve Got You Covered!

If you have questions about term life insurance or need help finding the right coverage for your family, contact the team at Vargas & Vargas Insurance. We’re experts at explaining insurance options and can help you find the best protection for your family’s future. Give them a call, and they’ll be happy to assist you in making this important decision.

Remember, choosing the right term life insurance is an important step in securing your family’s financial well-being. It’s a responsible way to show you care about your loved ones’ future.